does td ameritrade report to irs

Have you talked to a tax professional about this. Does Ameritrade report to the IRS.

Td Ameritrade Internal Transfer Form Fill Online Printable Fillable Blank Pdffiller

No TD Ameritrade does not sell your personal information to anyone.

. In other cases TD Ameritrade Clearing Inc. The detailed dividend statement you only need total qualified and. I use TD Ameritrade Institutional primarily in order to be most familiar with their process forms and procedures.

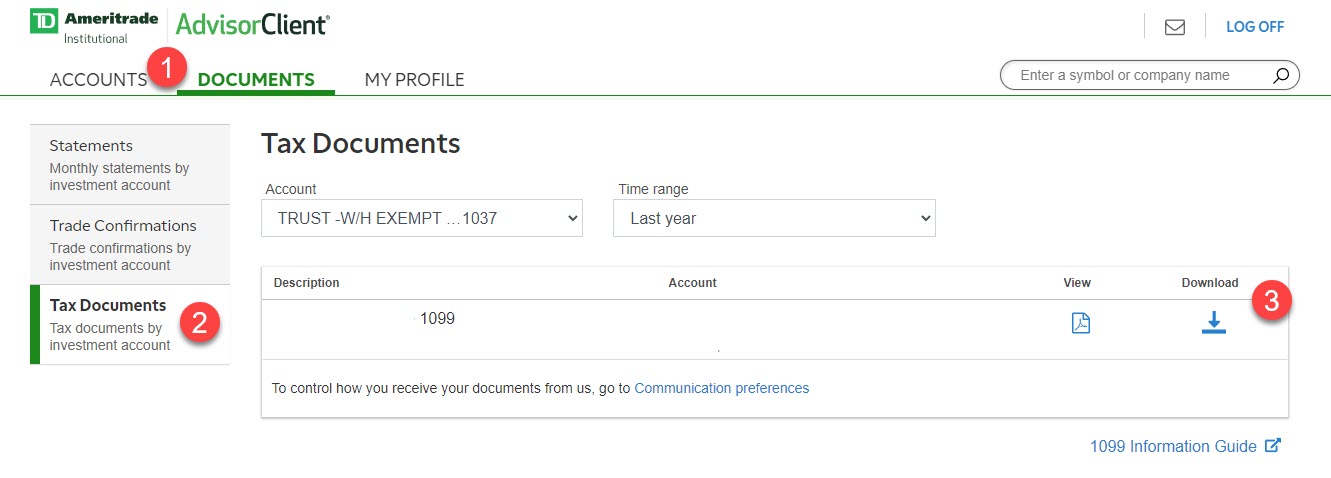

On my 1099 with TDA it shows an amount in Wash Sale Loss Disallowed on the basis reported to IRS line even though I held zero positions and all cash between 1130 and 12312021. Download this file and submit it for processing by our program. Understanding Form 1040.

1 Best answer dmertz Level 15 June 3 2019 1226 PM No the UBTI is taxable income to the IRA not to you. There are many custodian banks. You pay tax on it if you profit income tax rate if short term capital gains rate.

The topic of this. October 17 2022 Filing deadline for individuals who have automatic 6-month extensions may differ for those outside the United States Deadline to remove excess or recharacterize IRA. TD Ameritrade does not report this income to the IRS.

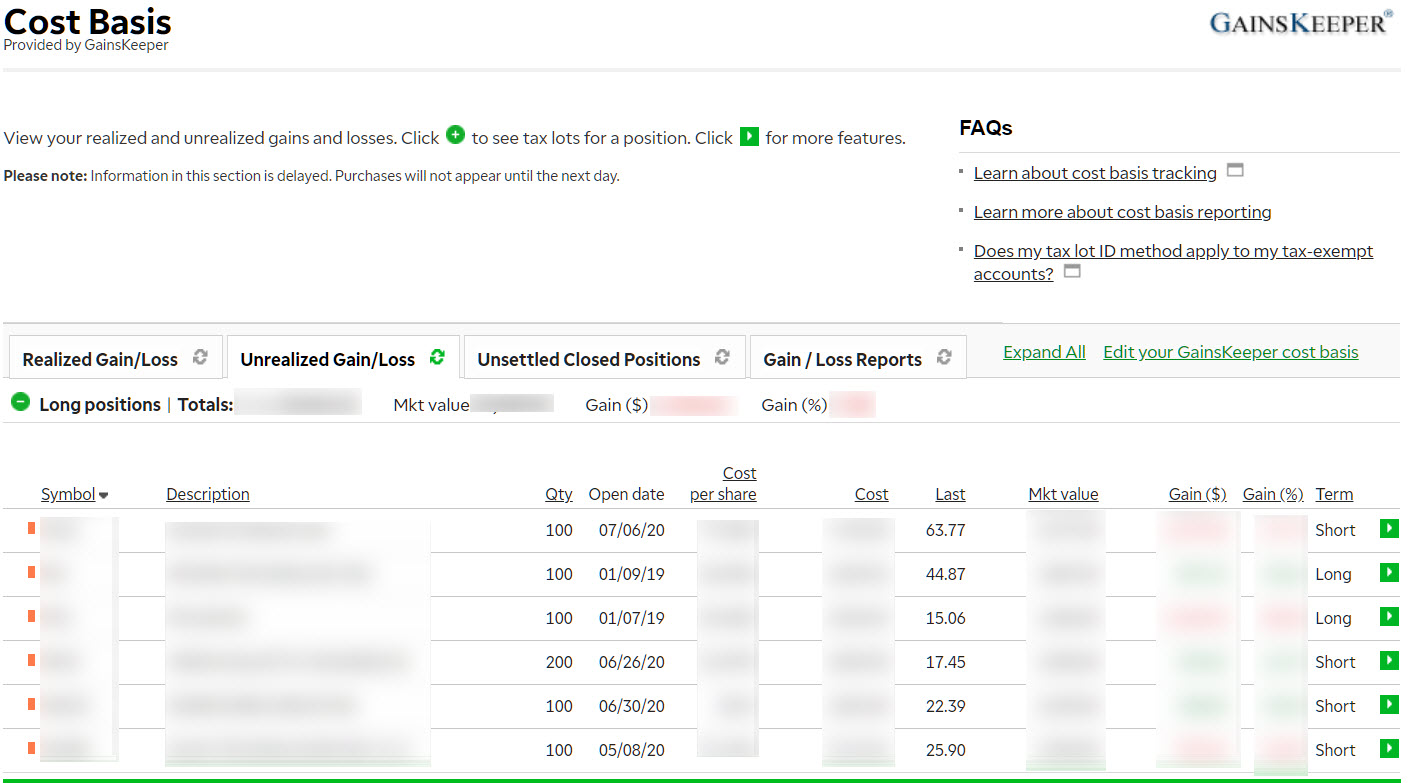

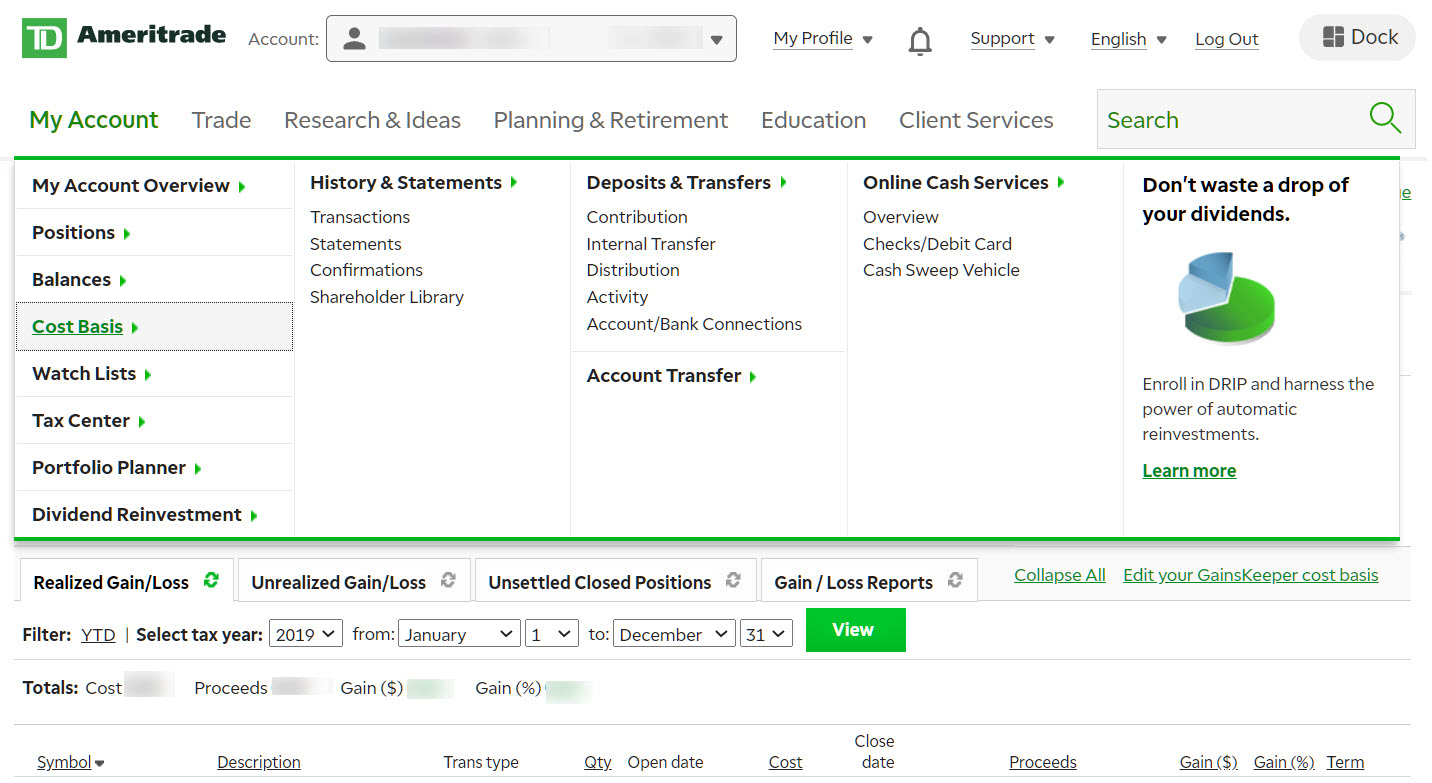

No you still have to report them. If youre mailing your tax return be sure to attach your summary statement to your mailed tax return. TD Ameritrade provides a downloadable tax exchange format file containing your realized gain and loss information.

Does TD Ameritrade Sell your Personal Information. Attach your summary statement to Form 8453 and mail both forms to the IRS. Individual Tax Return Form 1040 needs to be filed with the IRS by April 15 in most years.

The IRA must file Form 990-T and pay this UBIT reducing the balance in. There are two places where the 1099 B might show not reported to the IRS. Document ID Number What does TD Ameritrade report to IRS-----The most important part of our job is creating informational content.

Does TD Ameritrade take taxes. The custodian bank is charged with safeguarding your financial assets to report required information to the IRS eg 1099s etc and provide you statements of your holdings. TD Ameritrade will need to report to the IRS how much you.

Is required by federal andor state statutes to withhold a percentage of your IRA distribution for.

Fillable Online View Td Ameritrade Fax Email Print Pdffiller

Mr Rjb Jr S Td Ameritrade Statements March 2015 06 18 2015

Deciphering Form 1099 B Novel Investor

Account Terminated R Tdameritrade

1099 Information Guide Td Ameritrade 1099 Information Guide Td Ameritrade Pdf Pdf4pro

How To Read Your Brokerage 1099 Tax Form Youtube

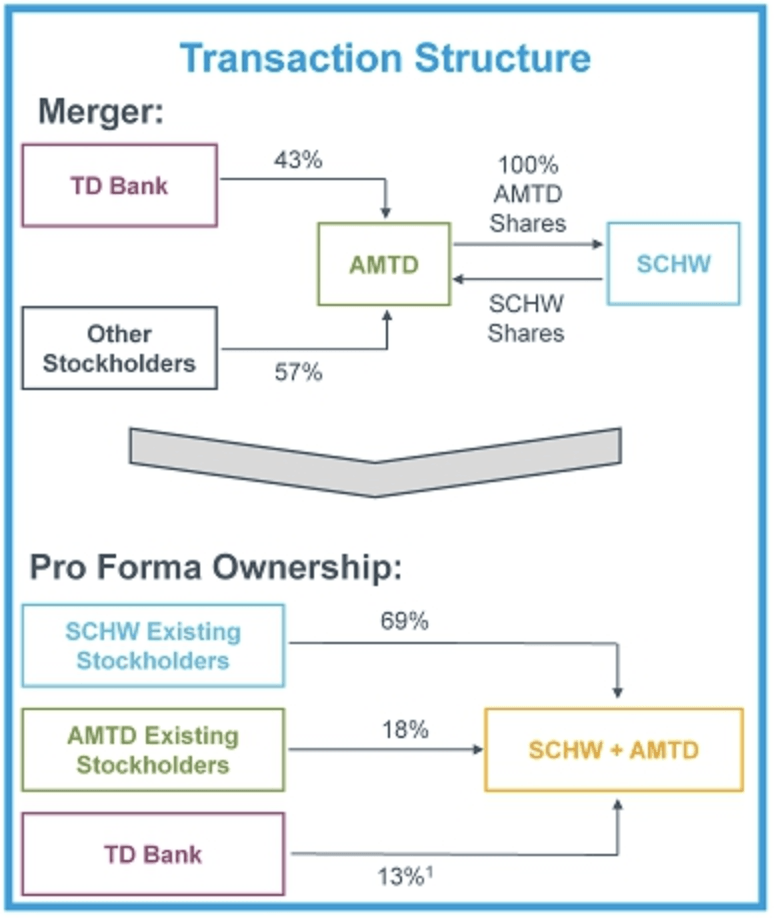

Charles Schwab And Td Ameritrade A Marriage Made In Heaven Nasdaq Amtd Old Seeking Alpha

Td Ameritrade Trek Client Learning Center

How To Report Section 1256 Contracts Tastyworks

How To Report Other Receipts And Reconciliations Partnership Distributions Received On A 1099 B From Td Ameritrade On My Tax Return Quora

Td Ameritrade Fined 500 000 For Failing To Report Advisers Suspicious Activities Investmentnews

Td Ameritrade Review 2022 The College Investor

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

Td Ameritrade Review A Leading Online Stock Broker

Equities Hold Stocks Bonds Mutual Funds In A Self Directed Ira

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

What Is Fatca And What Does It Mean For Investors